Hubert Moolman

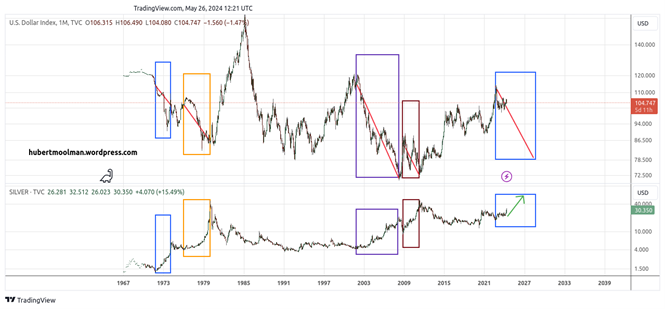

I am a qualified Chartered Accountant from Cape Town, South Africa. I am a self-taught gold and silver analyst. I am the author of a newsletter specializing in the fundamentals of gold, silver and money as well as fractal analysis.

I also have a website (http://hubertmoolman.wordpress.com) that publishes educational articles on gold, silver and the dangers of fiat money.

Disclaimer: The views expressed in this article are those of the author and may not reflect those of Kitco Metals Inc. The author has made every effort to ensure accuracy of information provided; however, neither Kitco Metals Inc. nor the author can guarantee such accuracy. This article is strictly for informational purposes only. It is not a solicitation to make any exchange in commodities, securities or other financial instruments. Kitco Metals Inc. and the author of this article do not accept culpability for losses and/ or damages arising from the use of this publication.